By Yves Engler

United Israel Appeal is the most important Israel-focused charity in Canada. Its violation of tax law highlights the hubris of Zionist charities, which have received billions of dollars in public subsidy over the years.

UIA is the principal Israel funding arm of Canada’s Jewish federations. With billions of dollars in assets the federations oversee community centers, museums, and other facilities. They receive tens of millions of dollars annually in government grants (and tens of millions more through tax receipts to donors). The federations claim half of all Canadian Jews as supporters. The federations’ official “advocacy agent” is the Centre for Israel and Jewish Affairs.

Since 1990 UIA has raised nearly $2 billion. Most of its money is transferred from the Toronto and Montreal Jewish federations.

During upticks in Israeli violence, UIA has usually launched special fundraising campaigns. They raised $100 million as the genocide began last year.

As a complaint submitted to the Canada Revenue Agency in May detailed, UIA has largely failed to account for its wealth transfer to Israel. From 1997 to 2022, UIA indicated $1.15 billion on its T2 (international) filings but only $6.6 million of this sum identified specific entities that received the money. The CRA has allowed this wealth transfer to undisclosed recipients in Israel to go on for years.

With pro-Israel charities facing greater scrutiny, UIA listed the recipients of most of their international donations in 2023. But they still couldn’t restrain themselves from violating the rules over assisting foreign militaries and illegal settlements. Their 2023 fillings list donations to groups assisting the Israeli military and West Bank colonies such as the Mizrachi Organization of Canada and the Cultural Zionist Association of Canada. In a more flagrant violation of the rules, UIA also made a slew of donations to municipalities in Israel. They donated to Kiryat Shmona Municipality, Yesodd Hamala Local Council, Mevoot Haherman Council, Upper Galilee Regional Council and other government entities. UIA openly calls “the government of Israel” one of its “key strategic partners … that act as agents in the delivery of programs in Israel.”

But CRA regulations don’t allow charities to fund foreign governments. In June the Director General of the Compliance Division of CRA’s Charities Directorate, Sharmila Khare, explained, “While certain registered municipal and First Nations groups that are listed on our web page may be qualified donees, governments outside Canada are not.”

UIA’s assistance to Israeli municipalities, West Bank colonies, and the IOF, as well as its failure to follow disclosure rules, reflects its indifference to the Income Tax Act. It also highlights the hubris of dozens of Israel charities, which is starting to catch up with them.

The CRA’s revocation letters for the Jewish National Fund highlight its extreme disregard for the law and CRA authority. In one of a slew of examples, the JNF responded to a CRA request for more complete paperwork about two projects by sending documents for a completely different project!

This is an organization that had sitting prime ministers, ministers, and corporate titans attend their events. With a $20 million annual budget, it’s not like the JNF didn’t have the resources to pay accountants or others to properly file its paperwork.

They seem to have believed their political connections would protect them, which was the case for far too long. In a recent briefing to 100 staff, former honourees, supporters and partners, JNF CEO Lance Davis said, “we did engage the Prime Minister’s Office. We did have two off-the-books meetings with the Prime Minister, so we did get indication that this would be handled, and this would be sorted out.”

According to a Canadian Jewish New report of the private briefing, Davis went on to say “And needless to say, it wasn’t. More than a year ago, we had an indication from — at the highest level — that this will be handled.”

Once it wasn’t “handled” — meaning an illegal political intervention into an independent audit process — the JNF publicly suggested the CRA was antisemitic. They then launched a campaign against what they labeled “targeted bias”. Apparently, the JNF believes they have the right to take hundreds of millions of dollars in taxpayer funds but it is discriminatory for the CRA to apply the rules.

Many pro-Israel charities violate the rules. Corruption among Israel-focused charities is so endemic there’s a “burner charity phenomenon”. According to Professors Miles Howe and Paul Sylvestre, “much like burner phones, burner charities appear disposable and readily replaceable. Tracking three burner charities (Gates of Mercy, Beth Oloth, and the Jewish Heritage Foundation) across two decades, we outline a relationship of activity and dormancy, wherein once an active burner charity has its charitable status revoked a subsequent burner charity is activated in its place.”

Howe estimates that “between 15-25% of all donations moving from Canada to Israel are unaccountable and potentially illicit.” At the extreme end are shadowy organizations like Jewish Heritage Foundation, Gates of Mercy, and Beth Oloth Charitable Foundation but even the ‘respectable’ UIA doesn’t follow the rules.

The Canada Revenue Agency needs to rein in genocide-promoting, lawbreaking, subsidized charities. It can start by seriously investigating United Israel Appeal.

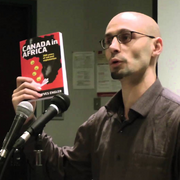

– Yves Engler is the author of Canada and Israel: Building Apartheid and a number of other books. He contributed this article to The Palestine Chronicle. Visit his website: yvesengler.com.

“The Canada Revenue Agency needs to rein in genocide-promoting, lawbreaking, subsidized charities. It can start by seriously investigating United Israel Appeal.”

The Canada Revenue Agency should also investigate the The Kashruth Council of Canada — among many other zio-scammers that hide behind the cloak of legitimacy — but prey upon the unwitting 98% non-Jewish consumers in order to profit for genocidal Israel.

People need to wake up! You cannot trust these liars. They are not our friends.